By Frank Kamuntu

In a notable development, DFCU Bank has encountered a legal setback in the Commercial Court of England and Wales regarding its efforts to secure financial protections against potential costs related to its ongoing litigation with Crane Bank.

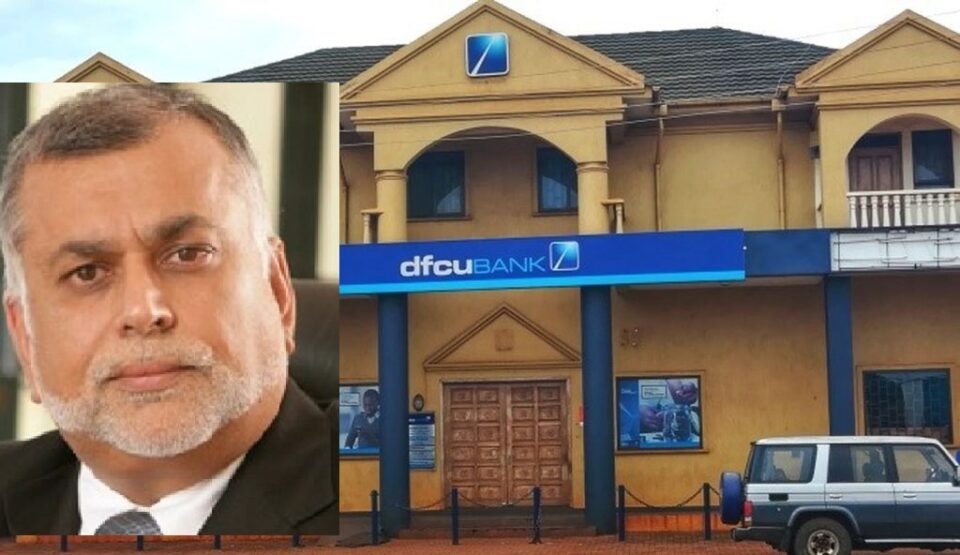

The High Court’s decision followed a request from DFCU and other defendants for Crane Bank and its co-claimants, including well-known Ugandan businessman Dr. Sudhir Ruparelia, to provide assurances for legal costs in the event of an unfavorable outcome.

Presided over by Mr. Stephen Hofmeyr KC, the case focused on DFCU’s contention that Crane Bank and its shareholders might lack the financial means to cover the defendants’ costs if they were to lose the broader case. This litigation involves allegations that high-ranking officials within the Ugandan government, in collaboration with the Bank of Uganda, executed a plan to take control of Crane Bank and subsequently sell it to DFCU at an undervalued price.

“Based on the evidence before the court, I am satisfied that the claimants have shown that there are such factors in this case. The two most pertinent factors, which work in tandem, are, first, that the second claimant is willing to undertake to pay any order the court may make that costs are to be paid by the claimants; and, second, that the second defendant is a “good mark” for those costs, i.e. that if a costs order were to be made against the claimants, the second claimant would be able to pay it,” partially reads the ruling in favor of Sudhir, it adds;

“Second, the second claimant is a person of very considerable wealth. In 2019, the second claimant’s wealth was estimated by Forbes to be some 1.2 billion USD. His substantial wealth includes Ugandan assets in the region of 279million USD, including unencumbered land and buildings of about 47 million USD and bank deposits of over 7 million USD, and property in the United Kingdom owned with his family valued at between £4.5 million and £5.5 million.”

Despite DFCU’s assertions regarding the necessity of securing costs, the court ruled against their application, favoring Crane Bank. Mr. Hofmeyr emphasized Dr. Ruparelia’s substantial financial resources, noting his willingness to provide a personal guarantee for any costs that may be awarded against the claimants.

Court records indicated that Ruparelia possesses assets worth hundreds of millions, including properties in Uganda and the UK, bolstering the court’s confidence in his capability to fulfill any financial obligations.

Mr. Hofmeyr remarked, “The second claimant, Dr. Ruparelia, is a person of very considerable wealth. This is an exceptional case, and there is no justification for an order for security for costs against him or the other claimants.”

Furthermore, the court considered the claimants’ history of promptly addressing previous cost orders, which weakened DFCU’s arguments for additional financial security. The judge also concluded that indemnities offered to some defendants by the Bank of Uganda did not warrant further security from the claimants.

This ruling represents a significant defeat for DFCU, denying the bank a crucial financial safeguard and reinforcing the determination of Crane Bank and Ruparelia to pursue the case. The litigation continues to attract attention due to the serious allegations surrounding the acquisition and undervalued sale of Crane Bank’s assets, which are central to the claimants’ case.

Crane Bank was sold in January 2017. The Bank of Uganda took control of the bank in 2016 fronting insolvency issues and later, fraudulently sold it to DFCU Bank.